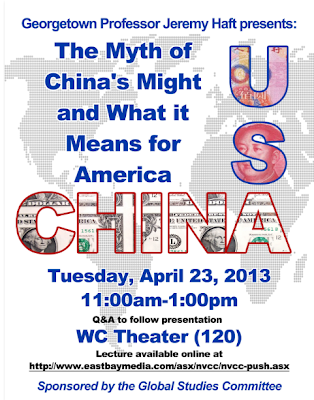

Guest Lecturer:

Professor Jeremy Haft, Georgetown University

April 23 11am-1pm

Woodbridge Auditorium

Open to all students and faculty

Professor Haft has been doing business in China for the past 15 years, inspecting and working with hundreds of factories in light and heavy industries. His new venture is focused on agriculture.

His view is the opposite of what one typically hears- that China is rising, America is declining and out debt to China is a national security risk. Actually, he says America has a big competitive edge over China in all respects. We are not in a race to the bottom on who has cheaper labor. America is currently creating and sustaining jobs across our economy through China trade and investment.

Exports are booming to China because of Chinese demand, not currency exchange rates. China needs what we make—even factoring in the costs of American labor, health care, etc. Aside from exports, the other big bi-lateral job creating/sustaining driver is China’s investment in America. China’s own policy (which they refuse to reform), actually prevents foreign currency (like dollars) to be spent domestically. So, China can’t invest its giant currency reserves at home for infrastructure and things like hospitals and schools. So, the scenario we often hear about that Chinese leaders have leverage over America because they can dump their holdings of treasuries, is a fantasy.

China is trying to diversify out of treasuries into assets, and that is also good as these investments create and sustain American jobs.

So, we should be encouraging MORE Chinese investment in American T Bills (which helps keep our interest rates low) and assets (which helps support and create jobs in the USA).

No comments:

Post a Comment