Ordering books from the bookstore can be a daunting prospect if you have never done it before. But really, the procedure is fairly simple. You can order the textbooks you need online and pay for them using your Financial Aid award any time between now and February 1, 2013.

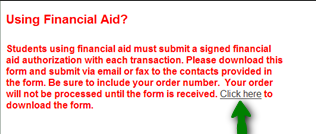

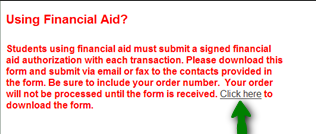

To obtain your books this way, go online to the ELI Bookstore, order your textbooks/ supplies, then check out. When you come to the screen where you can choose a payment method, first look above it for a paragraph in red (shown below). Read the paragraph and use the link labeled “Click here” to download an authorization form. You will need to complete this form and email or fax it to the fax number or email address listed on the form.

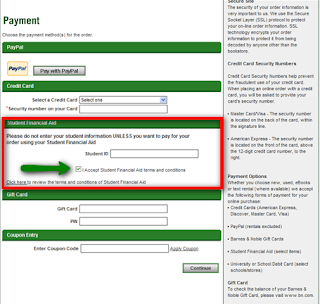

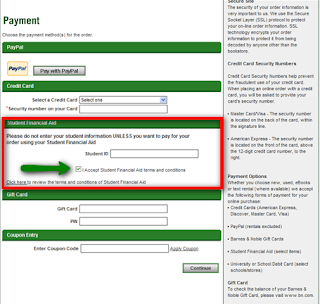

Then, in the Payment section, look for the Student Financial Aid option. Enter your student ID number and check the box next to “I Accept Student Financial Aid terms and conditions.”

To figure out how much you can purchase using Financial Aid, look at the amount you were awarded and have ACCEPTED for this semester. Subtract your tuition from this amount. The remaining amount is what you can use for purchases from the bookstore. Shipping costs can also be covered by your financial aid if you have enough.

If your textbooks and supplies cost more than your available financial aid, remove some items from your cart until the total plus shipping is less than or equal to your remaining available financial aid. Then order the rest of the supplies that you need in a different order and pay for them by whatever other method you wish to use.

To obtain your books this way, go online to the ELI Bookstore, order your textbooks/ supplies, then check out. When you come to the screen where you can choose a payment method, first look above it for a paragraph in red (shown below). Read the paragraph and use the link labeled “Click here” to download an authorization form. You will need to complete this form and email or fax it to the fax number or email address listed on the form.

Then, in the Payment section, look for the Student Financial Aid option. Enter your student ID number and check the box next to “I Accept Student Financial Aid terms and conditions.”

To figure out how much you can purchase using Financial Aid, look at the amount you were awarded and have ACCEPTED for this semester. Subtract your tuition from this amount. The remaining amount is what you can use for purchases from the bookstore. Shipping costs can also be covered by your financial aid if you have enough.

If your textbooks and supplies cost more than your available financial aid, remove some items from your cart until the total plus shipping is less than or equal to your remaining available financial aid. Then order the rest of the supplies that you need in a different order and pay for them by whatever other method you wish to use.